louisiana estate tax rate

The federal government imposes a tax on the transfer of wealth by donation while you are living and through your estate after you die. Based on latest data from the US Census Bureau.

Which States Have The Lowest Property Taxes Property Tax American History Timeline Usa Facts

This data is based on a 5-year study of median property tax rates on owner-occupied homes in Louisiana conducted from 2006 through 2010.

. Orleans Parish topped the list with a millage rate of 1541 with St. To find detailed property tax statistics for any county in Louisiana click the countys name in the data table above. At just 053 Louisiana has the fifth lowest effective property tax rate of any US.

The top inheritance tax rate is 10 percent no exemption threshold Massachusetts. Average Property Tax Rate in Louisiana. Three parishes in metro New Orleans were in the Top 10 with the highest property tax rates among Louisianas 64 parishes according to the Louisiana Tax Commissions annual report for 2017.

The average family pays 106000 in Louisiana income taxes. The data in the last three columns are actual millage rates from that report year. Louisiana is fairly tax-friendly for retirees.

Louisiana does not levy an estate tax against its residents. Compared to the nationwide 107 average effective property tax rate Louisiana has a generous rate at 053. The top estate tax rate is 16 percent exemption.

Actual property taxes may vary depending on local. The median annual property tax payment in Louisiana is 919 though this can drop to around 200 in some counties. Louisiana was listed on Kiplingers 2011 10 tax-friendly states for retirees.

An estate or trust may make estimated tax payments by filing Form R-541ES Fiduciary Income Tax Declaration of Estimated Tax or through LDRs online service Louisiana Taxpayer Access Point. However because of the varying tax rates between taxing districts the average tax bill fluctuates from parish to parish. On average a homeowner pays 505 for every 1000 in home value in property taxes with the average Louisiana property tax bill adding up to 832.

The Economic Growth and Tax Relief Reconciliation Act of 2001 phased out the state estate tax credit between 2002 and 2005 and replaced the credit with a deduction for state estate taxes for deaths that occur. In Louisiana theres a tax rate of 2 on the first 0 to 12500 of income for single or married filing taxes separately. One reason Louisiana has such low property taxes is the states generous homestead exemption which reduces the taxable value of owner-occupied properties by 7500 in assessed value.

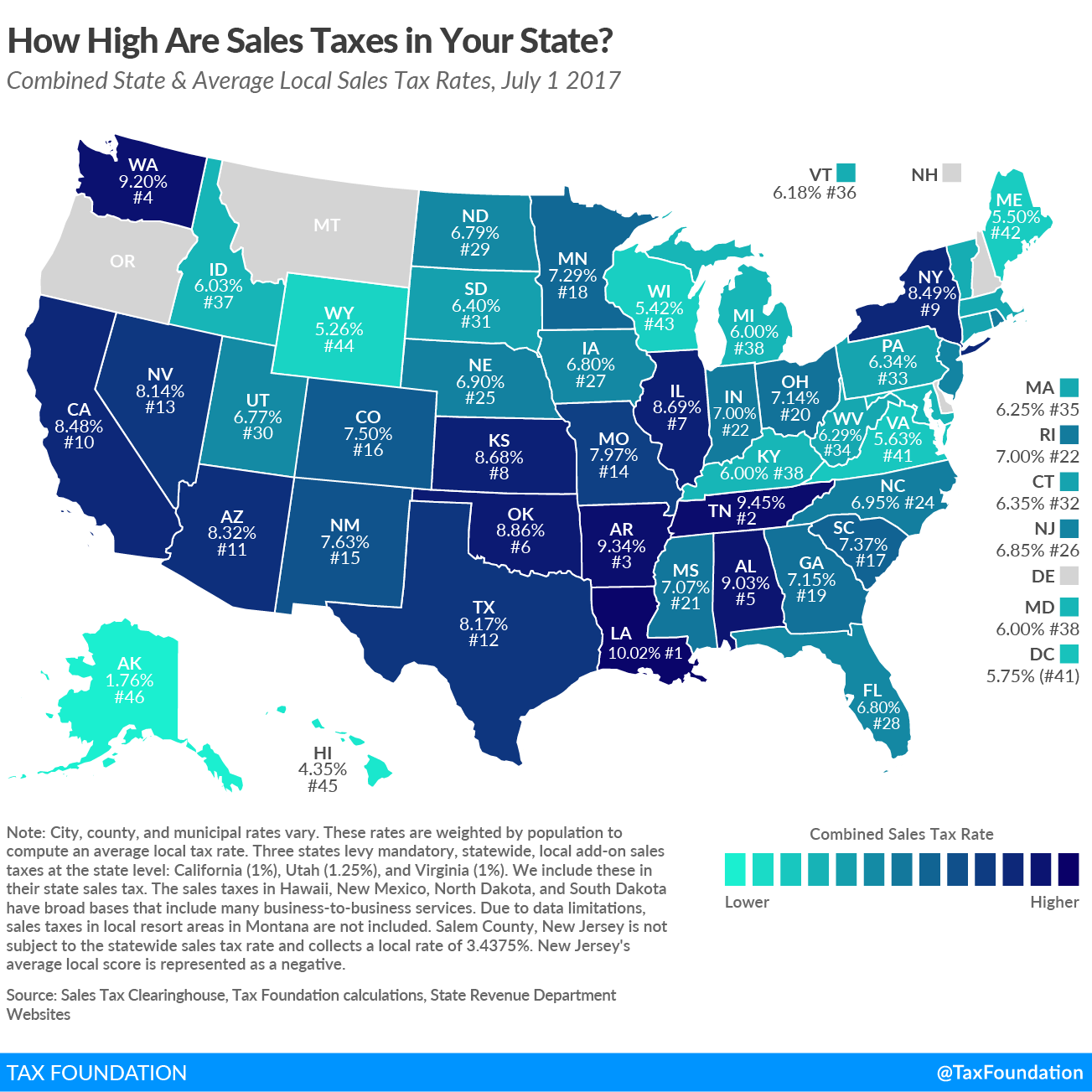

Nationwide the median property tax payment is a significantly pricier 2578. Louisiana has a 445 percent state sales tax rate a max local sales tax rate of 700 percent and an average combined state and local sales tax rate of 955 percent. Overall Louisiana Tax Picture.

The top estate tax rate is 16 percent exemption threshold. It is indexed. The property tax rates listed below are the average for properties in Louisiana.

If youre married filing taxes jointly theres a tax rate of 2 from 0 to 25000. You can look up your recent appraisal by filling out the form below. The rate threshold is the point at which the marginal estate tax rate kicks in.

That saves many homeowners hundreds of dollars. Depending on local municipalities the total tax rate can be as high as 1145. Louisiana Property Taxes Range.

Louisiana has one of the lowest median property tax rates in the United States with only states collecting a lower median property tax than Louisiana. Regenerated Max Mill Reports from 2005-2009 for all parishes except Orleans and Regenerated Max Mill Reports from 2006-2010 for Orleans Parish reflect the data in the current 2010 millage record in the columns entitled Purp - Roll Up. Learn all about Louisiana real estate tax.

There is also. The average effective rate is just 051. The portion of the state death tax credit allowable to Louisiana that exceeds the inheritance tax due is the state estate transfer tax.

Louisiana Income Tax Table. Louisianas median income is 54216 per year so the median yearly property tax paid by. For periods beginning on or after January 1 2022 fiduciaries are taxed on net income computed at the following rates.

Fortunately only 1 or less of total households are required a file an estate tax return. Declaration of Estimated Tax. The tax begins when the combined transfer exceeds the unified exemption.

The Louisiana LA state sales tax rate is currently 445. The top estate tax rate is 12 percent exemption threshold. Tammany the next highest in the metro area at 1468 mills followed by St.

In the case of immovable property which has been sold at tax sale the tax debtor has three years within which to redeem the property. Each states tax code is a multifaceted system with many moving parts and Louisiana is. Louisiana Tax Commission The Louisiana Tax Commission is a state agency vested with broad authority as to the administration and enforcement of the state property tax and assessment laws.

No estate tax or inheritance tax. Louisiana has the third lowest property tax rates in the nation. As Percentage Of Income.

The median property tax in Louisiana is 24300 per year018 of a propertys assesed fair market value as property tax per year. The median property tax in Louisiana is 24300 per year based on a median home value of 13540000 and a median effective property tax rate of 018. The state does not tax Social Security benefits or public pension income.

In 2018 that exemption was fixed at 11 million dollars for an individual and 22 million dollars for a married couple. It partially taxes income from private pensions and withdrawals from retirement accounts like 401k plans. The income tax in Louisiana is progressive and rates range from 2 to 6.

But just because Louisiana does not have an estate tax does not mean that the same is true for the federal government. Whether you are already a resident or just considering moving to Louisiana to live or invest in real estate estimate local property tax rates and learn how real estate tax works. 34th out of 51.

When it comes to estate tax Ive got some good news. Louisianas tax system ranks 42nd overall on our 2022 State Business Tax Climate Index.

Louisiana Inheritance Tax Estate Tax And Gift Tax

Do You Know Someone Looking For A Great Property In Haughton Please Pass This Along Heretohelp Diamondr Realtor License Louisiana Homes Real Estate Trends

Louisiana Sales Tax Small Business Guide Truic

Louisiana Estate Tax Everything You Need To Know Smartasset

Louisiana Estate Tax Everything You Need To Know Smartasset

Map The Most And Least Tax Friendly States Yahoo Finance Best Places To Retire Map Life Map

Historical Louisiana Tax Policy Information Ballotpedia

Estate Taxes New Orleans Orleans Parish Louisiana Lawyer Attorney Law Firm

Thinking About Moving These States Have The Lowest Property Taxes Property Tax Estate Tax Tax

Louisiana La Tax Rate H R Block

Louisiana Property Tax Calculator Smartasset

It S Surreal Louisiana Tax Collections Plummet Nearly 500m As Lawmakers Balance Budget Coronavirus Theadvocate Com

Louisiana Sales Tax Rate Remains Highest In The U S Legislature Theadvocate Com

Louisiana Property Tax Calculator Smartasset

Louisiana Estate Tax Everything You Need To Know Smartasset

Are There Any States With No Property Tax In 2020 Free Investor Guide Property Tax Indiana State States